FORMERLY The Personal Mortgage Group

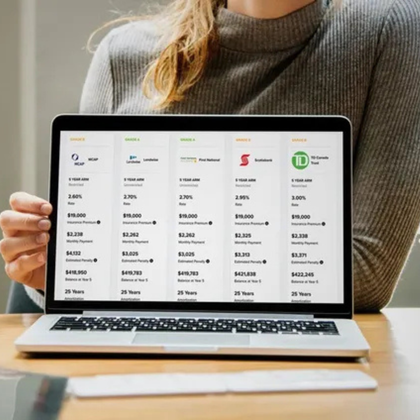

We dive deep into every detail and crunch the numbers,

ensuring you know exactly what you're doing and why.

FORMERLY The Personal Mortgage Group

We dive deep into every detail and crunch the numbers,

ensuring you know exactly what you're doing and why.

Working With US

Is SImple

Get started right away

The best place to start is to connect with us directly. Our commitment is to listen to your needs,

assess your financial situation, provide professional mortgage advice, and

guide you through the mortgage process.

Get clarity

Sorting through all the different mortgage lenders, rates, terms, and features can be overwhelming.

Let us cut through the noise. We'll outline the best mortgage products available with your needs in mind.

Proceed with confidence

Our goal is to make sure you

know exactly where you stand at all times.

From your initial application through your mortgage renewal, we're available to answer any questions you have.

Mortgage Services

We Have The Right Mortgage If You Are Looking For…

Click The Links Below To Learn More

Why Work

With Us?

The Team

Mortgage RESOURCES to keep you informed.

Sharing knowledge and empowering Canadians is in our DNA.

Our blog is filled with tips, tricks and expert advice that can help you save thousands.

WE PROUDLY SUPPORT